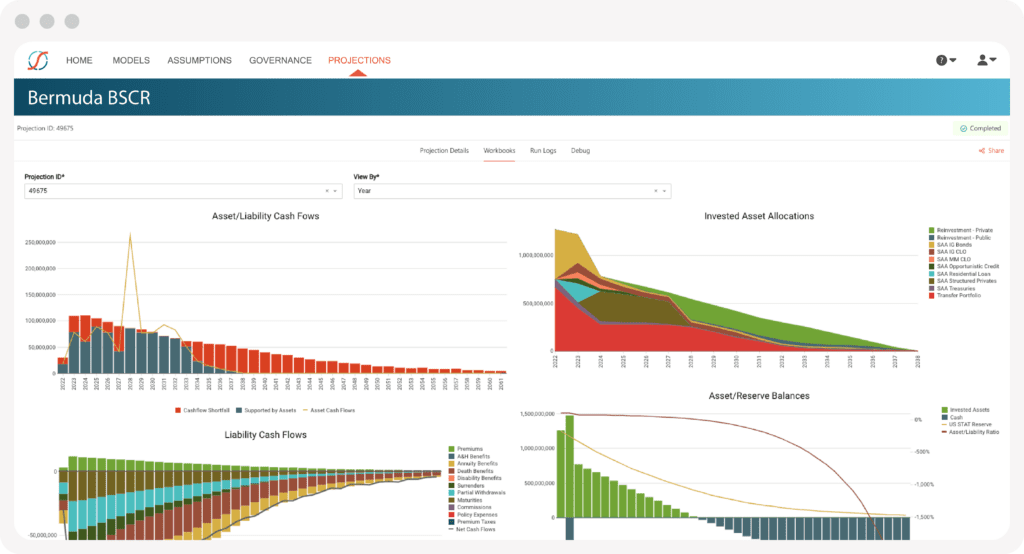

Bermuda Reporting

Quantify risk and

unlock value

SLOPE provides the support Bermuda (re)insurers they need to meet key regulatory requirements and beyond.

Technical provisions

Meet Reserve Requirements

Match your asset and liability cash flows under Scenario Based Approach with pre-built products in SLOPE’s actuarial library. Calculate Best Estimate Liabilities and Risk Margin with ease. Gain full visibility into and control of the calculational process.

- Conduct reinsurance in multiple forms on a Bermuda basis

- Support complex reinsurance arrangements

- Utilize pre-built products for direct insurance business

Unlock your team’s most

valuable asset – time.

SLOPE enables actuaries to save hours of tedious work, providing you with the insights you need to make the best decisions for your business.

BSCR

Demonstrate Adequacy

Streamline your actuarial workflow and mitigate human error. The SLOPE platform simplifies and automates repetitive tasks, allowing actuaries to allocate more time to high-value activities and ensure greater accuracy throughout.

How Does SBA Work in SLOPE?

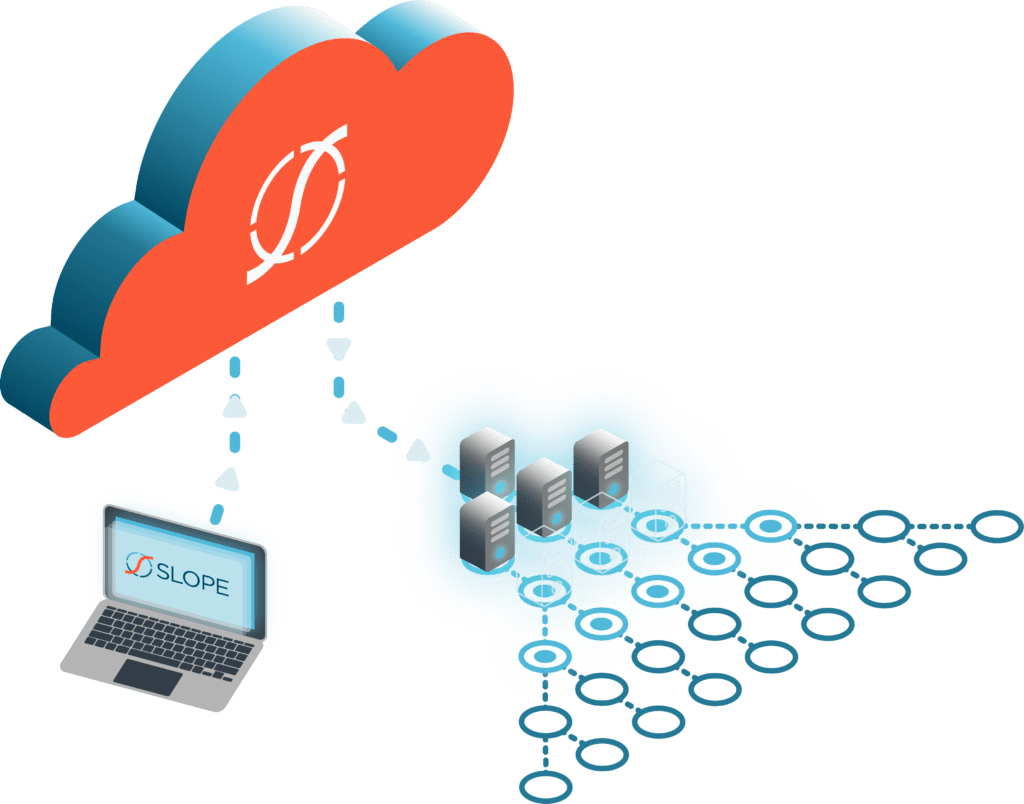

Cloud native

Future-Proof

Concerns about new regulations from the BMA being rolled out? No more waiting on slow development and release cycles from providers or rebuilding your models from the ground up. As a cloud-native platform, SLOPE quickly delivers product library updates as regulatory requirements change, keeping you in compliance.

International support

Beyond BSCR

SLOPE supports clients across the globe with a variety of risk-based frameworks, including standards such as US GAAP, STAT, Solvency II, and IFRS 17. Don’t see what you’re looking for? Get in touch to find out if we support an additional basis that you need.

Step into the future of actuarial modeling

Find out how SLOPE can transform your business with a personalized demonstration.