SLOPE vs. Prophet

One platform, deeper functionality.

No need for an entire suite of products to serve your actuarial team. SLOPE serves the process from beginning to end, from assumption management to actuarial analysis, all in a cloud-native environment.

MODERN ACTUARIAL PRACTICES USE SLOPE FOR FLEXIBLE, POWERFUL MODELING

Why Prophet?

SunGard developed the Prophet product suite (Professional, Enterprise, Data Conversion System, etc) throughout the 1990s and 2000s. In 2015, SunGard was acquired by FIS Global, who took over the management of the Prophet suite. In 2022, FIS rebranded the product set to “Insurance Risk Suite”, though many people on the team itself still refer to it as Prophet.

Prophet offers a well-built library of liability products in the life and annuity spaces and has strong capabilities for valuation work. Largely adopted in the international market, Prophet has a strong presence in the EMEA and APAC regions, despite having limited support for IFRS 17 functionality. Its presence in the US is limited, though significant, working primarily with the largest insurers in the long-tail space.

I can’t overstate the outstanding level of support that SLOPE gives to its customers.

Roger Loomis

VP, LifeCare AssuranceHow SLOPE compares to Prophet

SLOPE

- Cloud-native platform by nature

- All-in-one platform with enterprise features at entry level price

- Easy to read & understand models with visual coding

- Robust reporting capabilities

Prophet

- Expensive, limited cloud capabilities

- Requires add-on products for complete functionality

- Slow comprehension with proprietary pseudo-language

- (Unavailable in Prophet)

Why Actuaries Choose SLOPE over Prophet

Cloud-Native System

Prophet offers Managed Cloud Services, which moves the traditionally on-premise platform into a cloud-enabled state. Limited cloud capabilities such as increased compute and easier upgrading processes are either unlocked or managed by FIS, but not without a hefty price tag and slow initial implementation.

Actuarial teams who are looking for a true, cloud-native platform turn to SLOPE.

Better Development

Both Prophet and SLOPE are open systems, allowing actuaries to build sophisticated custom models. Prophet requires learning a proprietary pseudo-coding language, creating slow learning curves and difficult-to-parse formulas that are frustrating to maintain as changes are made.

SLOPE, on the other hand, provides clean, visual based model development. With no code required, formulas are much easier to understand and maintain for technical audiences and easier to read and explain to non-technical audiences.

Robust Analytics

Prophet has no analytical capabilities. Architecture that connects it to external software must be built and maintained, and the data exporting process can be slow. For companies under regulatory standards like IFRS 17 that require cohorting/aggregation, users may run into limitations in the platform.

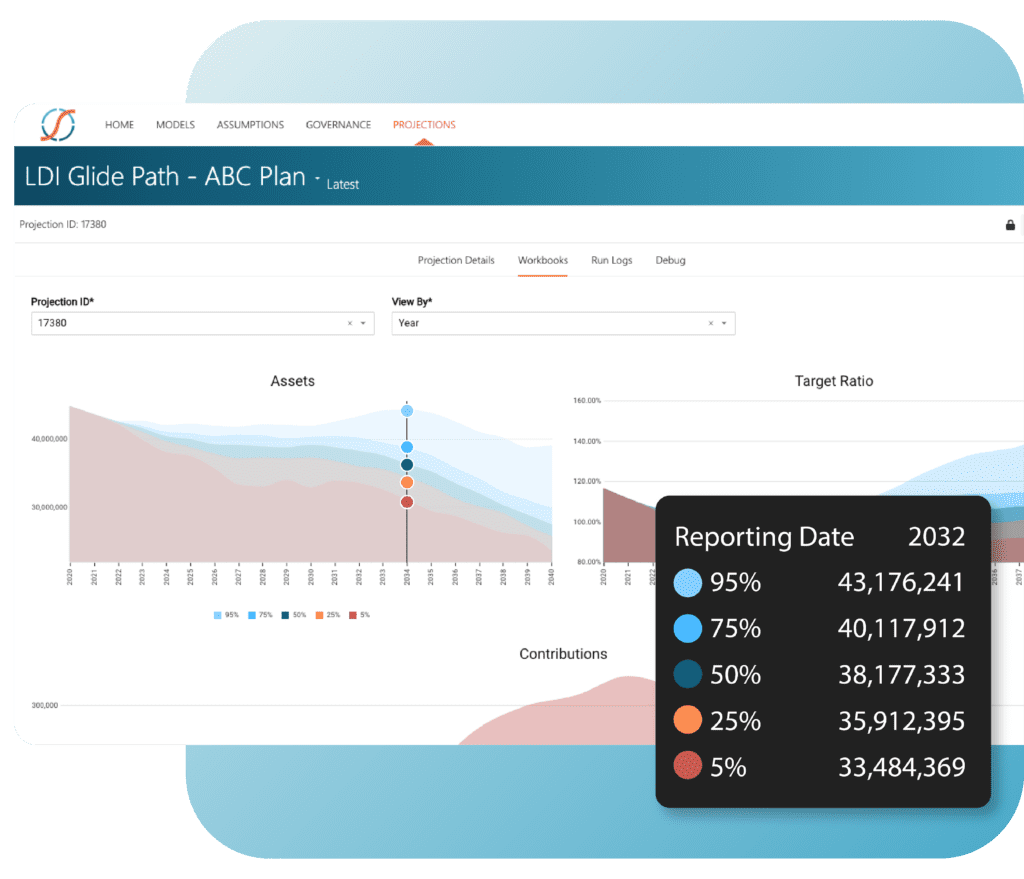

SLOPE has an embedded analytics with a suite of pre-built reports of your data that are instantly available as soon as a run is complete. Users can also build custom views to meet specific company or team goals, export their data to external tools, or automate the flow of data via API.

Accelerate your actuarial team.

SLOPE is the cloud-native actuarial modeling platform revolutionizing the way actuaries build models, manage assumptions, and analyze results. Actuaries drastically reduce the amount of time needed to perform their work while simultaneously reducing costs tied to inefficient processes & bloated infrastructure.