We recently had the pleasure of sitting down with Arthur Da Silva, the Vice President of Actuarial at Slope, who is widely recognized for his thought leadership in AI and the actuarial field. Arthur has been an influential voice in the Society of Actuaries (SOA) as Vice Chair for the Emerging Topics community and has delivered numerous talks on AI in the actuarial space. This blog post delves into Arthur’s career journey, his insights on the actuarial profession, and his experiences at Slope.

A Passion for Problem-Solving

Arthur, like many actuaries, had a knack for math growing up and found enjoyment in tackling challenging problems. This passion led him to the University of Waterloo in Canada, known for its strong Actuarial Science program. Exposure to the actuarial profession came naturally, thanks to his cousin who works as an actuary in Tokyo and a mentorship event at the university’s actuarial club.

These experiences solidified his interest in the actuarial career, particularly enjoying the client service aspect during his reinsurance role. This interest eventually guided him to a consulting position at Deloitte, where he spent over a decade working on actuarial modernization projects across the globe. His work involved helping clients adopt the latest tools and technologies, from AI and data visualization to low-code platforms.

His transition from Deloitte to Slope was driven by a desire to move to the U.S. and a chance encounter with Andy Smith, Slope’s Co-Founder and CEO, at an SOA panel on emerging technologies. “I really liked what he talked about at the time,” recalls Arthur, “And then when I saw the demo, the features of the SLOPE platform really blew my socks off. I remember coming out of that meeting with my jaw dropped…I really saw what the future of the actuarial profession, at least on the modeling side, would look like.”

Current Actuarial Challenges

Since joining as VP of Actuarial, Arthur has participated in numerous demonstrations for prospective Slope customers over the past year and was surprised at the diversity of challenges actuarial teams were facing. “I always thought, okay, companies are generally somewhat satisfied with their platforms,” Arthur shares, “And while that’s partly true in some cases, there’s also a lot of lingering problems.”

Despite the diversity of challenges that brought prospects to Slope, Arthur points out that they can almost always be connected back to the underlying issue of cycle time. “A lot of times, you think about model runtime as the main driver of time, but in reality, it’s a lot more than that…going from an idea in your head of what you want to build, to actually building it, testing it, validating the results, and then of course running the actual model, and then exporting those results – that’s cycle time.”

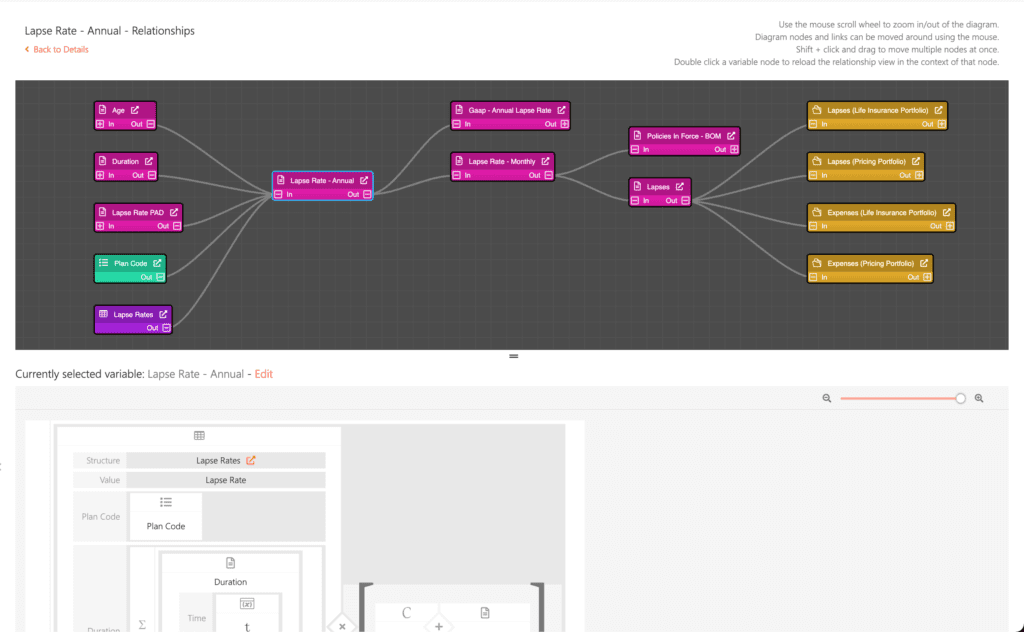

Even if a model’s run time is short, aspects of many teams’ platforms or processes can slow down an iteration, which significantly compounds over time, stealing away valuable time that could have otherwise been spent on analysis or strategy. In Arthur’s eyes, this is why the key benefit of SLOPE is its ability to streamline the entire actuarial modeling process. The platform’s integrated features for collaboration, model comparison, and results analysis significantly reduce the time and effort required for these tasks:

“You’ve got a huge toolbox that’s available to you just out of the box, which allows you to do all these sorts of things that in the past would have been three or four different software platforms that you’d have to get approval and budget for separately, and then you’d have to try and figure out how to integrate them together. It’s nice to have all of that under one roof.”

Advancing Actuarial Knowledge

Of course, Arthur’s influence extends beyond Slope, as he is a recognized voice in the realm of AI and actuarial work. For actuaries interested in exploring AI, he is quick to point out that professional actuarial organizations like Society of Actuaries and the American Academy of Actuaries will have the most relevant information pertaining to actuaries, but newsletters such as The Digital Insurer and Coverager can also provide valuable insights from an insurtech perspective.

As the Vice Chair of the Emerging Topics community at the SOA, Arthur and his team are exploring several key topics, including AI, cloud technology, and low-code platforms. They also focus on foundational education for entry-level actuaries through initiatives like modeling bootcamps.

For actuaries looking to establish themselves as thought leaders, Arthur offers valuable advice: “If you’re passionate about a topic, it will show in your preparation and presentation. You probably know a lot more than you think you do, at least relative to the people you’re speaking with.” He encourages actuaries not to let self-doubt hold them back and to start sharing their knowledge, as the best time to begin is often before one feels completely ready.

Arthur’s journey with SLOPE and his contributions to the actuarial field highlight the importance of innovation, collaboration, and continuous learning. At SLOPE, we are proud to have Arthur Da Silva leading our actuarial team and inspiring the next generation of actuaries to embrace modern tools and technologies in their work.

Join our team by visiting our career page to see available opportunities, or watch the full interview here.