Slope Software, and the SLOPE platform, were born out of frustration with poor user experience. Along the way, founders Andy Smith and Taylor Perkins have learned much about innovation, leadership, and how to do great work.

In this article, we’ll share some of those lessons and offer perspectives on how actuaries might apply them.

Before you throw your hands up and say, “Hey, wait, I’m not starting a software company any time soon,” we can explain. No, you might not be incubating the next unicorn in your garage on Saturday afternoons. But there’s a good chance you either are engaged in, or may soon be starting, a modernization or transformation initiative around your actuarial models and the infrastructure supporting them. Or you may be waist-deep in process improvement projects, product development, or an innovation department.

All of these pursuits are related, in that they essentially make something out of nothing. Whether you’re transforming your systems to modern architecture or finding new ways to do the work, you’re performing in a space that doesn’t have a ready playbook. W predefined set of instructions, and the output you end up creating may look very different from what the culture around you is used to. Even more, when you’re innovating, you’re often challenging the status quo, which can be a very high barrier to success.

Which means these lessons, learned in the same kind of “dive in and get dirty” experience, absolutely do apply to your work now and in the near future.

With that, we offer several Lessons Learned from Starting a Software Company:

1. Innovation Is Not “Just Do the Same Things Faster”

Early on, there was a clear difference in focus. Andy, as the actuary, tended to think in terms of processes and tasks. He was experienced with several actuarial software platforms, and this experience biased his thoughts. He had been trained to frame everything around fixed processes he was accustomed to, without ever questioning why those processes existed in the first place.

On the other hand Taylor, a software engineer, was most focused on outcomes and goals. He had no point of reference for some of the specific tasks that Andy thought he wanted to perform. This naïveté on Taylor’s part forced him to constantly ask, “Yeah, but why do you want to do that? And why that? And why that?” They dug deeper and deeper, past the surface level processes, to understand the purpose and goals of those specific data transformations, algorithmic calculations, or output presentations.

This allowed them to understand the best ways to reach those goals and then build with that in mind. Innovation came from challenging existing processes, not assuming that the goal was simply replicating those processes in a faster way.

A faster horse, or a car?

As Henry Ford is purported to have said, “If I had asked people what they wanted, they would have said faster horses.” [He probably never said it, and his innovation was about the assembly line, rather than the automobile itself, but just go with us here.] The point is this: People often can’t articulate what they really want, because they are biased by what they’ve been doing all along.

Heck, people probably don’t even want horses or cars. They want to get themselves and their stuff from one place to another. They kind of don’t care how it gets done. Yet in Ford’s time, because they’d been riding horses for so long, they would have been conditioned to think “faster horse”. They would have no idea that the alternative of “replace the horse with something different” was possible.

Same with innovation and transformation. You will continuously need to inspect the tasks you already perform, question them, challenge them, and force them to defend themselves as worthy of your efforts at making them better. If those tasks are in service to some other, higher goal, refocus your efforts at getting to that goal, however you might be able to do so.

2. Innovation Requires Uncertainty, Risk, and a Healthy Dose Of Failure

Think about the space race and how many early rocket designs crashed and burned before anything even got into orbit. And even since we’ve made it to the moon, we haven’t solved all the problems. There’s a whole host of failures and close–but–not-quite experiences that make for fantastic entertainment and great engineering case studies.

When building something new for the actuarial space, sure, there’s not as much physical risk. It’s not like your spreadsheet is going to flame out on you and ignite your cubicle (or home office). But when there’s no instruction manual, there’s a much greater chance that what you’re attempting to do may not get you the results you’re striving for.

In developing SLOPE, there were several failures along the way: failure to properly understand the scope of the endeavor; failure to adequately understand the importance of selling; even failure to hire the right people.

If your perspective is that one setback ends the game, then obviously you’re never going to get anywhere. Each of those negatives (failures) becomes a learning experience, as long as you learn from it. If you see each exercise as a trial, and an opportunity to expand your knowledge base, you’ll be well on your way to making the innovation exceptional.

We’ll expand more on this later, in lessons 4 and 5. For now, we’ll remind you of this quote from Thomas Edison:

“I have not failed. I’ve just found 10,000 ways that won’t work.”

3. You Can’t Do It Alone

Both Andy and Taylor admit that, during the initial stages, they each would have quit several times over without the other alongside. This is because they could ask questions, refine their thinking, and, at times, just vent.

Partners are there to support, to encourage, to challenge, and to reduce your load every once in a while. You simply can not make something innovative or disruptive alone. There is too much uncertainty, too much risk, and too much failure for one person to handle. Especially when challenging long-established paradigms, which is what most actuaries pushing for any kind of transformation will face.

Not only is the volume of work too large, it requires a diverse skill set (including such “soft skills” as project management, negotiation, collaboration, and delegation) which are not generally developed via the examination process. This is where partners will be valuable, because they will have skills that you don’t, and vice versa.

Inertia may be the most powerful force in the universe. Entrenched ideas are notoriously difficult to dislodge. Even more when you’re trying to upend a status quo which has been in place for decades. So it is incredibly helpful to have someone else to share the burden of dealing with the push-back that is going to come as you challenge those mindsets that the current audience is comfortable with.

Not only is the work too much for any one brain to comprehend, it can be incredibly frustrating to deal with the ups and downs of innovation, where it often feels like two steps forward, three steps back, six steps forward, five steps sideways. This is the nature of change and adaptation; you don’t know what you don’t know.

It is vital, then, for any innovation initiative to be headed by more than one individual. Partnerships where you’re sharing both the responsibility (and the credit for the wins) are what’s going to help you sustain the work until the end.

4. Look for Complementary Skill Sets

In conjunction with #3 above, your partners need to bring something to the partnership that you don’t have. Taylor and Andy had some overlapping skill sets, but in many other ways, they could fill in the gaps where skills were missing.

Andy had the domain knowledge: he knew with certainty what he wanted to do with the software solution, in terms of actuarial calculations. But he was basically clueless when it came to designing software, optimizing runtime, hosting it on the cloud, and building security and usability for a final solution.

Taylor certainly knew how to design a good user experience. But he would be the first to admit his blank slate when it came to the final work product (such as a term insurance policy premium or an excess capital calculation), regardless of the algebra taking place underneath the hood.

In this case, Taylor’s lack aligned well with Andy’s expertise, and vice versa. As above, it’s worthwhile to seek out those whose skills round out the gaps in your skill set.

A note of warning: It may be comforting to seek out and work with people who think like you. There’s a lot of similarity in communication styles, you already speak the same language, and you won’t have to admit you can’t do something that comes up. However, this is a false security, because while actuaries may be very good at performing actuarial work, and have a healthy feeling of competence from completing actuarial examinations, the actuarial skill set is not comprehensive.

Which also points to the next lesson:

5. You Don’t Know What You Don’t Know

It is tempting to think that you know a lot, because you know a lot about your specific job, your specific company, or your specific industry.

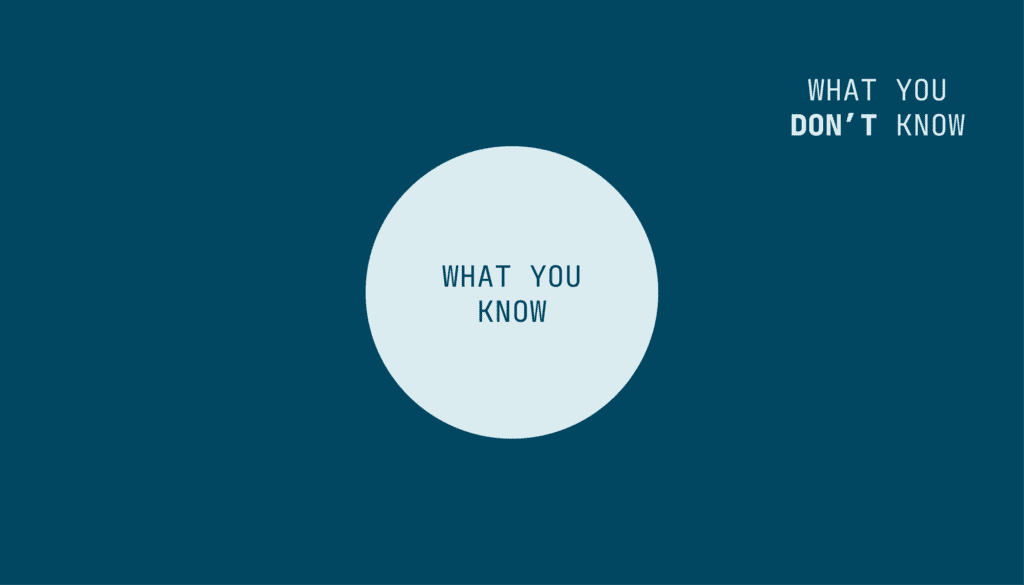

But there are a lot of moving parts when it comes to any company, insurance policy, or experience study. Suppose that what you know is contained within this circle:

Well, then, what you don’t know is everything outside the circle. Which is, what, exactly? Everything else. And that everything is unlimited, because basically there’s an infinite amount of information available in the world.

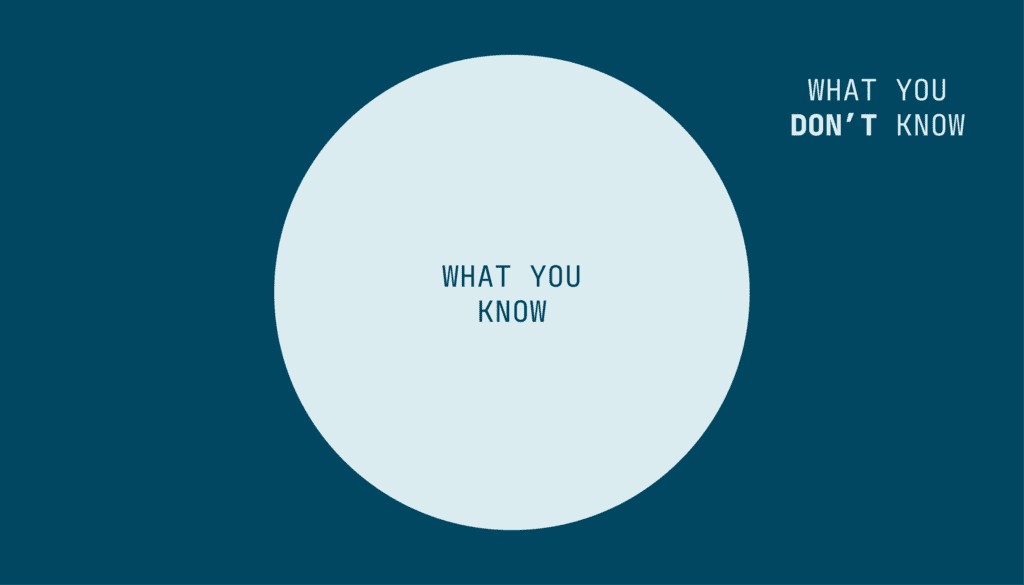

So you, when you’re starting out, are inside that circle. Which means you only know what you know. Which means you often ask a lot of questions, in order to expand your circle of knowledge. That is never a bad thing, As you learn more, you increase the size of the circle:

But there’s still a lot that’s outside that circle. In fact, there’s still an infinite amount you don’t know.

Maybe you don’t know that you don’t know how to effectively prioritize your time on a new project, because you’ve been doing what you do for years and it’s second nature, so you don’t need to prioritize. Maybe you don’t know how to adequately evaluate the tradeoffs between usability and functionality of a new actuarial system, because you’ve only ever worked in one.

The point is, you don’t know what you don’t know. And again, reinforcing what we said above, because you don’t know what you don’t know, it’s vital that you have others who can help you to see what your gaps are, whether they be partners or advisors or external reviewers.

Which leads directly into the next lesson: how do you identify gaps?

6. Seek Out Advisors and Mentors Who Have Been There

From peers who have performed similar efforts to external advisors, mentors are invaluable. They provide an external, independent view of your status, progress, and challenges in your way.

They can help you to refine your message, they can point out your flaws and gaps in knowledge, and they can steer you away from problems you didn’t even know could be right in your path.

After starting their company, it was indescribably valuable for Taylor and Andy to participate in the TechStars program. This gave them connections necessary to start building their network. As a result of raising money and adding several advisors to the team, they have expanded that network considerably and increased their opportunity for objective information exponentially.

In the actuarial space, you’re probably not raising capital. But you could be advocating for a budget allocation for a new technology, or an efficiency project. The advisors you might look to include project sponsors, managers and mentors, and so on. Or they could be the vice president that you last worked for ten years ago, who’s been to a couple of different companies since then, and has been successful in improving processes along the way.

Could even be someone from another department who’s had the kind of results you’d like to see for your specific initiatives.

Trust us, not only because you don’t know what you don’t know, but because you’re actually incapable of seeing your flaws, you need people outside you to tell you what to watch out for, where you’re going wrong, and how to correct.

And now Andy and Taylor are often sought out for their expertise and advice from other entrepreneurs and innovators.

How do you find these advisors?

So how do you find those partners? Well, you’ll first have to put in some effort and look for people who’ve done what you have done before. LinkedIn is a great tool for this, as well as professional societies, conferences, and trade publications. Find articles, podcasts, and webinars that resonate and reach out to the authors or speakers.

Additionally, peers and higher-ups at your company can be invaluable resources. They have a vested interest in ensuring your success, because it helps their success as well. Reach out to them and build a relationship on shared values: “We both want the project to be successful, yes? Could we have lunch later this week to just make sure we’re both thinking along the same lines?

Finally, don’t just assume you can only talk to actuaries. The tendency to look to other actuaries as the only people with good advice is quite stifling. Reach out to product managers, underwriters, sales leaders, administrators, IT gurus, and even people in completely different industries. Actuaries have never had a monopoly on knowledge. Expanding your horizons by looking beyond your immediate discipline can only improve your experience.

Many are willing to help. The only way to know if they will help you is to ask.

We have much more to say about these lessons learned. Stay tuned for Part 2.