SLOPE vs. ProVal

Powerful reporting, flexible system.

SLOPE provides pension actuaries with rich analytics, advanced functionality such as PRT and LDI, and the ability to customize models to accommodate unique pension plans.

MODERN ACTUARIAL PRACTICES USE SLOPE FOR FLEXIBLE, POWERFUL MODELING

Why ProVal?

Built in 1994 by WinTech, ProVal has established itself as a major pension valuation software. It is strong in its narrow product focus of pension valuation and is well-known in the industry today.

I can’t overstate the outstanding level of support that SLOPE gives to its customers.

Roger Loomis

VP, LifeCare AssuranceHow SLOPE compares to ProVal

SLOPE

- Cloud-native, centralized workspace

- Powerful analytics and visualizations instantly generated from completed runs

- Pension Risk Transfer functionality

ProVal

- Local installation, difficult collaboration

- Limited output, requires additional tools for comprehensive reporting capabilities

- PRT unavailable in ProVal

Why Actuaries Choose SLOPE over ProVal

Cloud-Native Solution

ProVal is an on-premise solution, and it requires a lot of additional support to run as a result. Dedicated machines for runs, IT support for updates, and working with other teams on shared models are all significant drains on resources. In contrast, SLOPE provides users with a seamless experience as a cloud native platform; collaborate remotely with other actuaries in a shared workspace and platform updates roll out automatically.

Rich Analytics

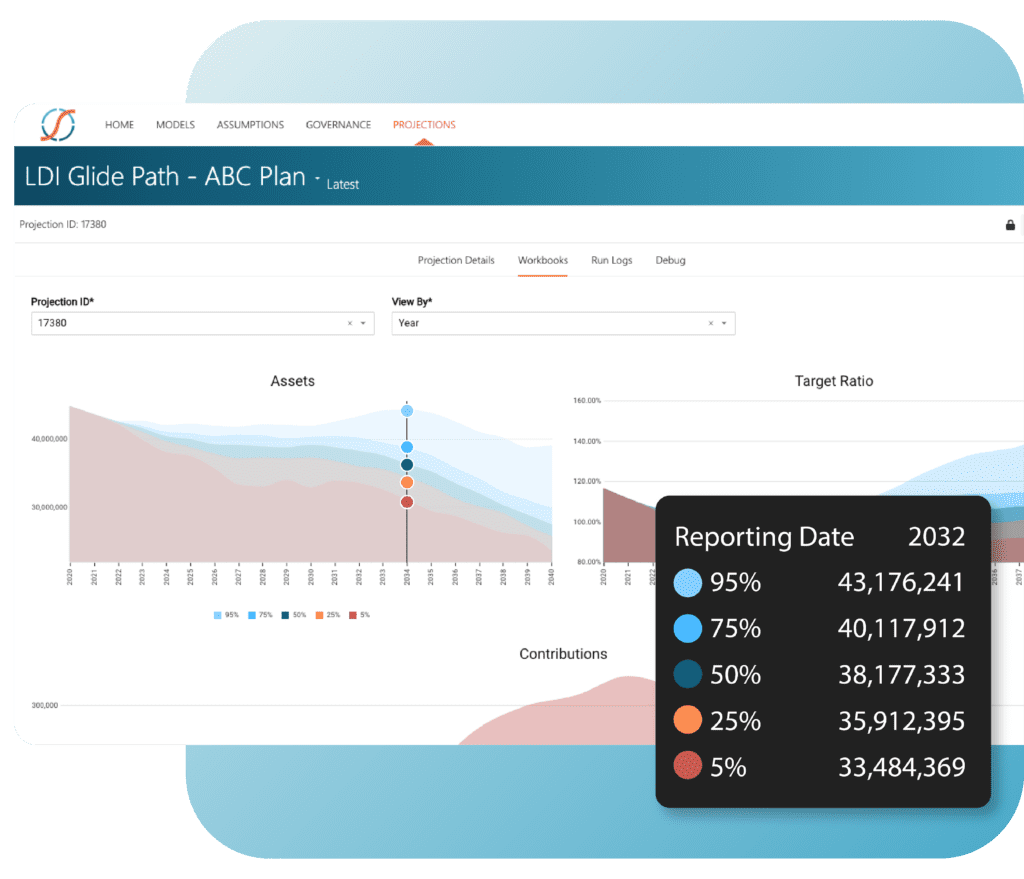

Output from ProVal is limited to tabular data – users must either purchase a separate visualization tool or build out external processes to conduct meaningful analysis and reporting. SLOPE provides embedded analytics that generate visuals automatically upon run completion. Users can find value in a suite of pre-built reports and build custom dashboards specific to their business needs.

Advanced Capabilities

ProVal is a strong tool for running valuations for pension plans, but is limited in its capabilities elsewhere. In addition to this, SLOPE provides significant gains for pension actuarial functionality with its ability to run projections, conduct Liability Driven Investing, and pricing for Pension Risk Transfer all in a single platform.

Accelerate your actuarial team.

SLOPE is the cloud-native actuarial modeling platform revolutionizing the way actuaries build models, manage assumptions, and analyze results. Actuaries drastically reduce the amount of time needed to perform their work while simultaneously reducing costs tied to inefficient processes & bloated infrastructure.